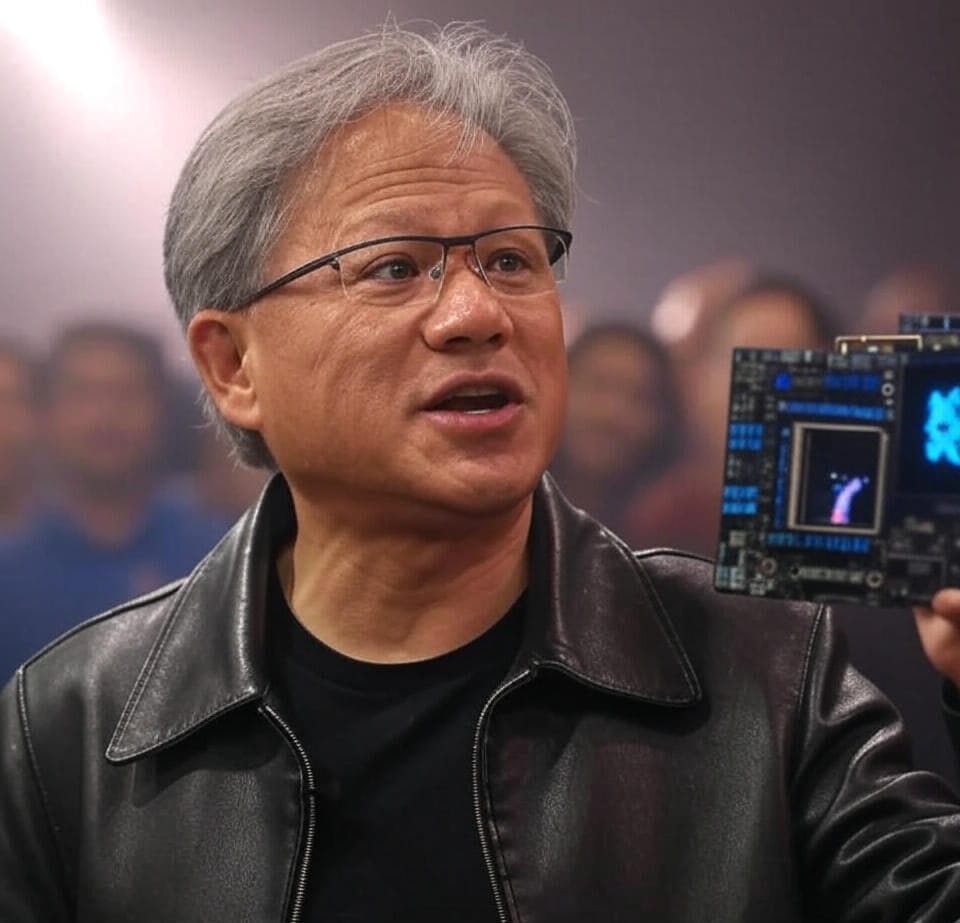

On July 9, 2025, NVIDIA Corporation achieved a historic milestone, becoming the first publicly traded company to reach a market capitalization of $4 trillion. This landmark event, marked by a 2.5% increase in its stock price to a record high of $164.42 before closing at $162.88, underscores NVIDIA’s preeminent position in the global semiconductor and artificial intelligence (AI) sectors. With a valuation approaching the gross domestic product of India, NVIDIA’s achievement reflects its pivotal role in driving technological innovation and economic transformation.

Strategic Ascendancy in AI and Semiconductors

NVIDIA’s ascent to a $4 trillion valuation is a direct result of its strategic leadership in AI, a sector experiencing unparalleled growth. Originally renowned for its graphics processing units (GPUs) tailored for gaming, NVIDIA has redefined its portfolio to meet the escalating demands of AI infrastructure. Its GPUs, commanding a 90% share of the data center AI market, are integral to machine learning, generative AI, and high-performance computing applications. This dominance is driven by robust demand from enterprises, hyperscalers such as Amazon Web Services, Microsoft Azure, and Google Cloud, and government-led initiatives prioritizing AI sovereignty.

The company’s financial performance further validates its market position. In its fiscal first quarter of 2026 (ended April 27, 2025), NVIDIA reported a 69% year-over-year revenue increase to $44.1 billion, propelled by a 73% surge in data center revenue. Earnings per share rose from $0.60 to $0.76, reflecting operational efficiency and market strength. Citigroup analysts, citing NVIDIA’s leadership in AI infrastructure, raised their stock price target to $190 from $180, projecting the AI data center market to reach $563 billion by 2028.

Leadership in Sovereign AI and Global Collaboration

A cornerstone of NVIDIA’s success is its pivotal role in sovereign AI—AI systems managed by individual entities, often governments, to ensure data security and autonomy. Chief Executive Officer Jensen Huang has emphasized NVIDIA’s near-universal participation in sovereign AI initiatives, with strategic partnerships in the United Kingdom, France, and Germany. These collaborations focus on developing localized AI ecosystems, reinforcing NVIDIA’s global influence.

NVIDIA’s Blackwell architecture, optimized for AI inference workloads, has solidified its technological edge, enabling faster and more efficient processing for advanced AI models. The company’s Arm-based GB200 systems have driven a 134% increase in the global server market, which reached $95.2 billion in the first quarter of 2025. Additionally, NVIDIA’s expanded offerings, including inference microservices and AI guardrails, have strengthened its partnerships with hyperscalers, enhancing its ecosystem’s scalability and versatility.

Market Influence and Economic Implications

NVIDIA’s $4 trillion valuation has had a profound impact on global financial markets, catalyzing a technology-led rally in the Nasdaq and S&P 500. The company’s stock has appreciated 22% year-to-date in 2025, surpassing the S&P 500’s 6% gain and the Philadelphia SE Semiconductor Index’s 15% increase. This performance underscores NVIDIA’s role as a bellwether for the technology sector, with its valuation exceeding the combined market capitalizations of several leading technology firms.

The milestone also highlights the growing economic significance of AI. As enterprises and governments invest heavily in AI infrastructure, NVIDIA’s GPUs serve as critical enablers, akin to foundational tools in a transformative technological era. However, recent insider sales exceeding $1 billion, including potential transactions by CEO Jensen Huang valued at approximately $900 million, have prompted scrutiny. Analysts attribute these sales to routine financial planning rather than diminished confidence in NVIDIA’s long-term prospects.

Challenges and Strategic Considerations

Despite its commanding position, NVIDIA faces notable challenges. U.S. trade policies, including tariffs and restrictions on its H20 processors in China, have resulted in a $4.5 billion inventory write-off and an estimated $8 billion in lost revenue. While NVIDIA has navigated these constraints effectively, ongoing geopolitical tensions could pose risks to its global operations. Furthermore, competitors, including Microsoft, are exploring alternative AI chip designs to reduce dependency on NVIDIA’s GPUs, signaling potential shifts in market dynamics.

NVIDIA’s elevated valuation also invites scrutiny regarding its sustainability. While its price-to-earnings ratio reflects robust growth expectations, it leaves limited margin for operational or market disruptions. Nevertheless, NVIDIA’s first-mover advantage, comprehensive software ecosystem (including CUDA and AI Enterprise), and continuous innovation provide a formidable competitive moat.

Future Outlook

NVIDIA’s $4 trillion market capitalization is not merely a financial achievement but a testament to its role in shaping the future of technology. As AI adoption accelerates across sectors such as healthcare, finance, automotive, and entertainment, NVIDIA’s GPUs and software solutions will remain integral to global innovation. The company’s strategic investments in U.S.-based AI supercomputer manufacturing, with Blackwell chip production in Arizona and facilities in Texas, position it to meet rising domestic demand.

For investors, NVIDIA represents a compelling opportunity tempered by the need for careful valuation analysis. For the broader technology sector, its success signals the dawn of an AI-centric era, where scalability and innovation will define market leadership. As Jensen Huang recently stated, “AI is the most transformative technology of our time.” NVIDIA’s historic milestone on July 9, 2025, solidifies its position as the vanguard of this paradigm shift, setting a benchmark for technological and economic excellence.

Sources: Reuters, The Economic Times, Times of India