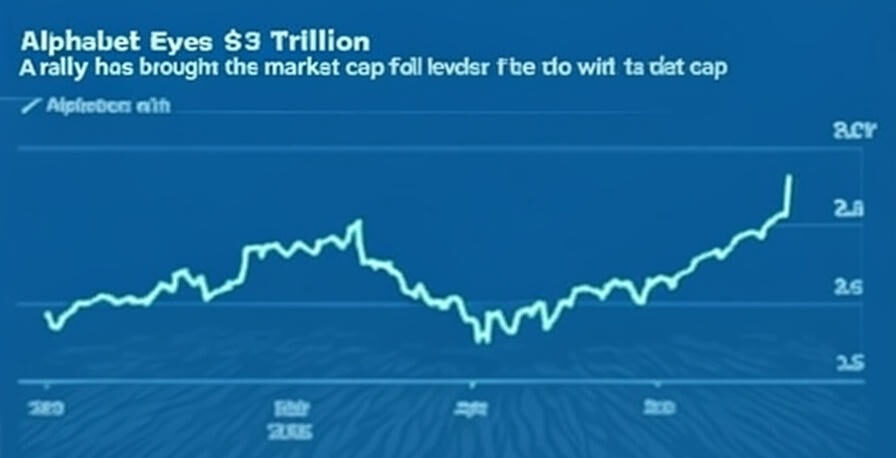

On September 16, 2025, at 08:04 PM PKT, the technology sector celebrated transformative milestones, with Alphabet Inc., Google’s parent company, at the forefront. This blog provides an in-depth analysis of Alphabet Inc.’s recent achievements, alongside contributions from Oracle Corporation and Tesla Inc., in reshaping market valuations. These developments underscore the sector’s resilience and strategic influence, offering critical insights for professionals and stakeholders tracking Alphabet Inc.’s impact on this pivotal Tuesday.

Alphabet Inc. Milestones and Market Valuations

Alphabet Inc. achieved a historic milestone by reaching a market capitalization of $3 trillion on September 15, 2025, establishing it as the fourth U.S. firm to attain this valuation. This success is driven by robust investor confidence in Alphabet Inc.’s artificial intelligence integrations across its ecosystem, including search, cloud services, and autonomous driving technologies. A favorable antitrust ruling further alleviated regulatory pressures, enhancing Alphabet Inc.’s market leadership and reinforcing its position as a global tech innovator.

Oracle Corporation experienced a significant stock surge, propelled by its AI-enhanced cloud computing services. This growth has elevated co-founder Larry Ellison’s standing in global wealth rankings, highlighting the financial impact of AI-driven enterprise solutions. Oracle’s focus on scalable cloud infrastructure continues to attract substantial business adoption.

Tesla Inc. marked a notable recovery, with its stock rising 85% from April lows, erasing earlier 2025 losses. This turnaround was supported by CEO Elon Musk’s strategic $1 billion share repurchase, reflecting confidence in Tesla’s advancements in electric vehicles and energy technologies. The move has strengthened investor trust in the company’s vision.

Impact on Investment Trends

- Alphabet Inc.’s $3 trillion valuation signals a strong market preference for AI-driven technologies.

- Oracle’s cloud success underscores growing demand for enterprise AI solutions.

- Tesla’s stock recovery highlights investor confidence in sustainable energy innovations.

- These milestones, led by Alphabet Inc., may influence future capital flows into tech and green sectors.

Strategic Innovations Driving Alphabet Inc. Growth

AI Integration in Alphabet Inc. Success

Alphabet Inc.’s milestone is underpinned by its seamless integration of artificial intelligence across its product offerings. Innovations in search algorithms, Google Cloud, and Waymo’s autonomous driving technology have solidified Alphabet Inc.’s leadership, supported by the recent antitrust ruling that ensures uninterrupted expansion.

Oracle’s growth is fueled by its AI-enhanced cloud platform, providing businesses with advanced data analytics and operational efficiency. This strategic focus complements Alphabet Inc.’s influence in the enterprise technology market.

Tesla’s recovery reflects its commitment to innovation in electric vehicles and energy storage, supported by Musk’s financial strategy. While distinct, it aligns with Alphabet Inc.’s broader tech ecosystem influence.

Financial Implications for Stakeholders

The financial achievements, particularly Alphabet Inc.’s valuation, indicate a robust investment climate. Professionals are advised to assess the long-term potential of AI technologies led by Alphabet Inc., as this sector is poised for continued expansion.

Market Influence and Economic Outlook

Global Market Dynamics Led by Alphabet Inc.

The surge in valuations, with Alphabet Inc. at the helm, influences global market dynamics within the technology sector. This trend may prompt increased competition and innovation as firms seek to match Alphabet Inc.’s success.

Economic Indicators and Future Projections

Upcoming economic data releases, anticipated to impact Federal Reserve policies, will shape the tech market’s trajectory. Alphabet Inc.’s milestones suggest a positive outlook, provided macroeconomic conditions remain supportive.

Future Market Implications

The corporate milestones of September 15-16, 2025, highlight the technology sector’s financial strength, with Alphabet Inc. leading the charge through its $3 trillion valuation. Oracle’s AI leadership and Tesla’s recovery in sustainable technologies further enhance this robust growth trajectory. Stakeholders are encouraged to monitor Alphabet Inc.’s trends and their broader economic ramifications closely. For comprehensive insights, consult financial reports and industry analyses from authoritative sources.