The cryptocurrency market experienced a robust surge on July 3, 2025, as Bitcoin (BTC) climbed above $108,800, marking a 2.5% increase, while Ethereum (ETH) posted an impressive gain of over 6%, trading above $2,560. This rally, supported by favorable macroeconomic signals and growing institutional interest, has bolstered the global crypto market capitalization to approximately $3.31 trillion, reflecting a 0.8% rise. The surge has sparked optimism among investors, with altcoins like XRP, Solana, and Cardano also recording notable gains. This article investigates the driving components behind the rally, specialized bits of knowledge, and the broader suggestions for the cryptocurrency advertise.

Market Performance Overview

As of 1:04 PM IST on July 3, 2025, Bitcoin rose 2.3% to $109,336, briefly outperforming $110,000, a critical point of reference that activated over $101 million in brief liquidations.Ethereum, in the meantime, recorded a 6.3% increment, coming to $2,601, with examiners noticing a clear breakout from $2,375 to over $2,550.The total crypto market capitalization grew by 0.8% to $3.31 trillion, according to CoinMarketCap, with 24-hour trading volume surging by 30.88% to $126.76 billion. Altcoins such as XRP, Solana, Dogecoin, and Cardano saw gains ranging from 3% to 9%, while Tron, Sui, Avalanche, and Chain Link posted increases of up to 11%. The meme sector also performed strongly, with Bonk (BONK) jumping 20.06%, driven by news of a potential 2x leveraged ETF launch by Tuttle Capital.

Key Drivers of the Surge

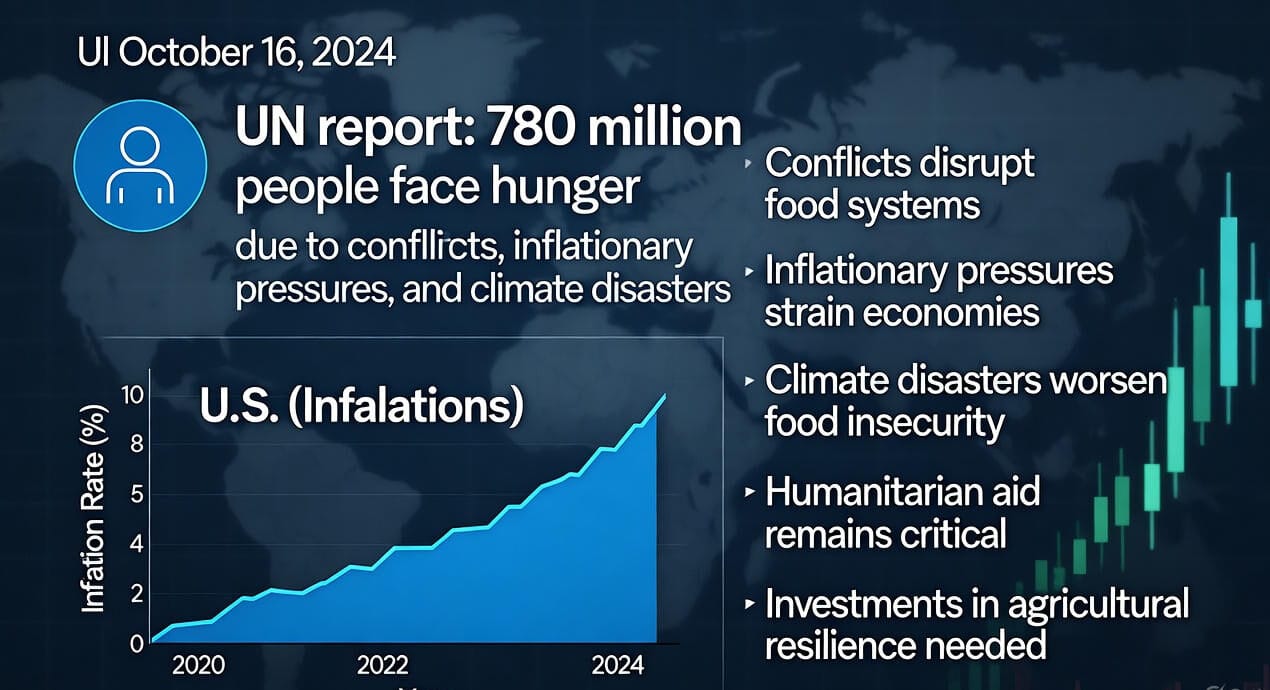

Several factors contributed to the bullish momentum in the cryptocurrency market. Firstly, dovish macroeconomic signals, including weak U.S. payroll data showing a 33,000 drop in private payrolls, have fueled expectations of a potential Federal Reserve rate cut in July. Lower interest rates typically enhance investor appetite for riskier assets like cryptocurrencies.Furthermore, a 4.5% increment within the U.SM2 cash supply to a record $21.94 trillion has been cited as a basic catalyst, as extended liquidity frequently drives theory into computerized assets.

Institutional interest continues to play a pivotal role.Bitcoin exchange-traded reserves (ETFs) are nearing $50 billion in total inflows, whereas Ethereum ETFs have outperformed $4.25 billion. BlackRocks iShares Ethereum Believe drove later inflows with $40 million, reflecting developing certainty in Ethereum’s part in decentralized back (DeFi) and tokenization. The surge in Bitcoin’s futures open interest, which spiked to 689.78K BTC (approximately $75 billion), further underscores institutional engagement. Moreover, easing geopolitical tensions, including a U.S.-Vietnam trade agreement and a ceasefire between Iran and Israel, have reduced market uncertainty, supporting the rally.

Technical Analysis and Market Sentiment

From a technical perspective, Bitcoin has broken through its short-term descending trendline, signaling a shift in momentum. Analysts highlight resistance at $110,348, with support zones between $105,000 and $102,560. A close above $108,500 could confirm a bullish engulfing pattern, increasing the likelihood of new all-time highs, potentially reaching $112,000 or even $117,000 by year-end. Ethereum’s technical setup is equally promising, with the Relative Strength Index (RSI) at 47.18, indicating growing momentum.Investigators extend Ethereum might hit $2,800 in July on the off chance thatit underpins over the 20-day fundamental moving ordinary (SMA).

Advertise assumption has moved emphatically, with the Fear and Covetousness Record reflecting an adjusted viewpoint.However, analysts caution that high funding rates and short-term volatility could trigger pullbacks, particularly if Bitcoin fails to breach the $110,000 resistance. The liquidation of $331 million in short positions across the market, with $248.85 million from Bitcoin alone, highlights the intensity of the current rally and the risks for bearish traders.

Altcoin Performance and Sector Highlights

The altcoin market has mirrored Bitcoin’s upward trajectory, with notable performances in various sectors. Cardano led altcoin gains with a 7% spike, supported by favorable U.S. policy developments and tax reform hopes. Solana rose 3.6%, buoyed by the launch of its U.S. spot ETF, while XRP gained 4.9% amid improved regulatory clarity following Ripple’s filing for a U.S. banking license. The meme sector saw significant activity, with dogwifhat (WIF) up 16.56% and Bonk (BONK) surging 20.06%. The AI sector also performed strongly, with Virtuals Protocol (VIRTUAL) and ai16z (AI16Z) rising 13.33% and 16.05%, respectively, driven by growing interest in blockchain-based AI applications.

Challenges and Risks

Despite the bullish momentum, challenges remain. Analysts warn of potential volatility due to high funding rates and geopolitical risks, such as proposed U.S. tariffs on Japanese imports exceeding 30%. Additionally, demand for cryptocurrencies in China has weakened, as evidenced by a 1% discount on Tether (USDT) against the USD. Ethereum faces investor uncertainty regarding its network’s value proposition, particularly as it approaches its 10th anniversary. A failure to break key resistance levels could lead to a retest of lower support zones, such as Bitcoin’s $100,000 mark.

Future Outlook

Looking ahead, market participants are focused on upcoming events, including Federal Reserve Chair Jerome Powell’s comments on interest rate policy and the U.S. House vote on tax reforms. These developments could further influence crypto market dynamics. Bitcoins potential to reach $200,000 by year-end, as anticipated by a few examiners, pivots on maintained organization inflows and favorable macroeconomic conditions.For Ethereum, upgrades like the Spectra protocol and increasing stablecoin adoption could drive prices toward $2,800 in the short term, with long-term forecasts suggesting a high of $8,705 by 2027.

Conclusion

The cryptocurrency market’s surge on July 3, 2025, underscores its resilience and growing appeal as an asset class. Bitcoin’s climb above $108,800 and Ethereum’s 6% rise above $2,560 reflect a confluence of macroeconomic, institutional, and technical factors. While risks such as volatility and geopolitical uncertainties persist, the market’s bullish momentum suggests potential for further gains. Investors should remain cautious, monitoring key resistance levels and macroeconomic developments to navigate this dynamic landscape effectively.

Sources:

- The Economic Times

- TradingView News

- Coinpedia.org,,

- Bitget News

- CryptoSlate

- CoinDesk