Last Sunday, April 6, 2025, Bitcoin saw a sharp fall, losing around 5% of its worth to be traded for $78,892.92. For those who are into crypto and the ones who have invested in it, this decrease may come across as a surprise in the middle of a year that was full of ups and downs for digital currencies. However, people are curious about the reasons for the most recent recession in the crypto market. Would you mind explaining the reasons so that we are also aware of this information and predict the future market of Bitcoin

Stimulus: Economic Policy Shocks

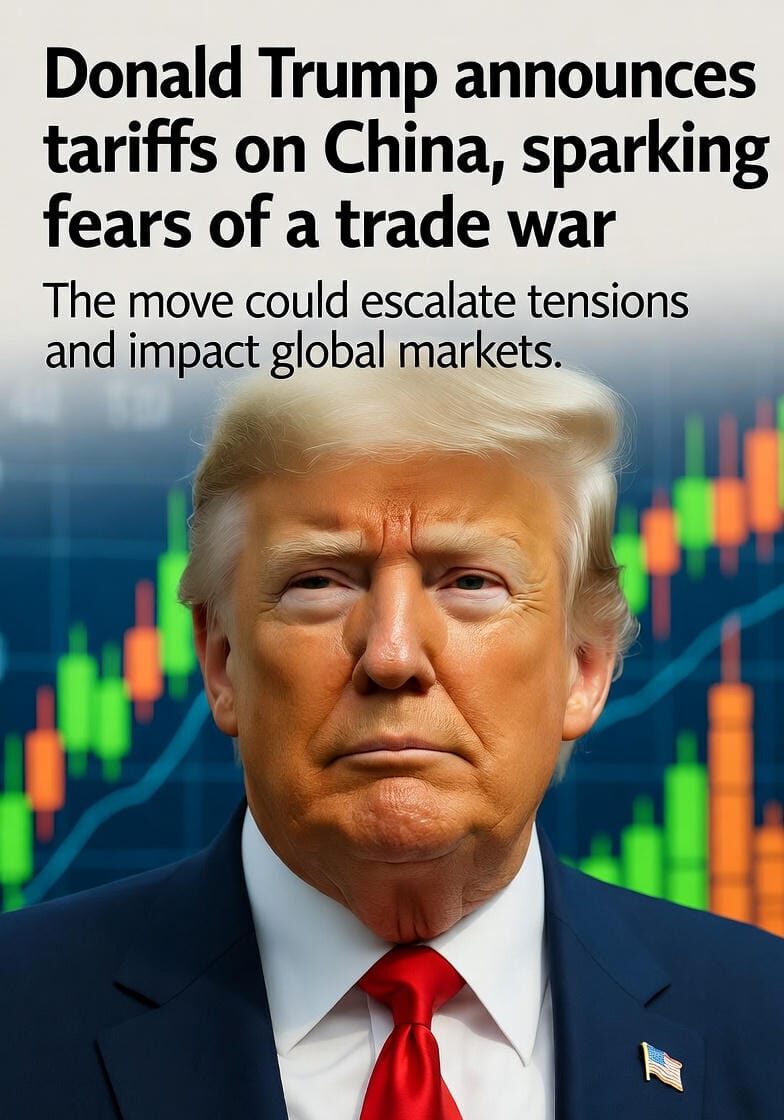

There is no cryptocurrency free of the influence of other markets, so the reduction is the result of the market reaction to radical changes in traditional financial markets. It is obvious that the driving force behind this is the lined-up and included in aggressive tariff policies of the U.S. President Trump, which have been the talk of the town this week. Last April 5, a 10% initial tariff was imposed on all the imports of the U.S. Next, from April 9, additional tariffs hitting 185 countries’ products will be activated. Such activities have caused global market panic—the US stock index futures have fallen down a cliff, namely, the S&P 500 futures 4%, Nasdaq has declined 4.3%, and Dow is crashing 3.7%.

Blockchain technology of Bitcoin that often acts as a hedge against the traditional market downturns can still be affected. It is common for investors to withdraw from volatile assets such as cryptocurrencies in times of economic uncertainty like these that are currently being experienced. The fact that Trump worsened the existing tariff conflicts in the world might be just the thing that has pushed digital currency and other asset classes into a downward spiral. A fear of international trade conflict, at least a complete resetting of the global economy, might be affecting all financial markets including cryptocurrencies increasingly negatively.

Broader Market Volatility

It isn’t just the crypto market going down; if we consider the scenario of India’s Nifty 50 index on April 7 the index opened at 21,758 from 22,904 with India VIX inflating more than 50%, there we have a different situation. The trading day was full of bad surprises, among which were Trent and Tata Motors stocks taking severe losses. The worldʼs financial systems continue to be extremely interconnected, besides Bitcoinʼs decentralized nature, the crypto still seems to be rather responsive to certain macroeconomic variations.

Historically, Bitcoin has been a subject of double-edged opinions on the aspect of volatility. Some people may regard it “digital gold”, as the shelter protecting one from the fury of distressed times, while others refer to it as a speculative commodity prone to enormous changes. The significance of Sunday’s dip is that the latter point of view may now hold the upper hand with traders, suggesting the way in which they give a bunch of responses to the unforeseen side effects of policy changes.

What’s the Future of Bitcoin.

With Bitcoin at $78,892.92, many would still think it’s unbelievable that just a while ago it could have been considered something outrageous. However, this small pullback is indicative of certain question marks hanging over its head. Is a recovery expected, or would we rather see an extension of the disturbance? Only a few factors would be enough to form the prospect:

1. Trade War Result: In case PM Shigeru Ishiba of Japan is to make America exempt itself from tariffs by choosing to visit the U.S., a situation of less pressure might be seen in the markets, and Bitcoin can act accordingly. On the contrary, if the friction over trade is increased even more, the risk-off sentiment might be taken to a different level.

2. HODLers: Cryptocurrency is a confidence market. In the situation the decline we are facing makes small investors nervous and they start selling, this could prompt a steeper decrease. On the other hand, bottom fishers must be excited and regard this as a lucky opportunity, given that there are essential levels in place the price won’t drop below like $75,000.

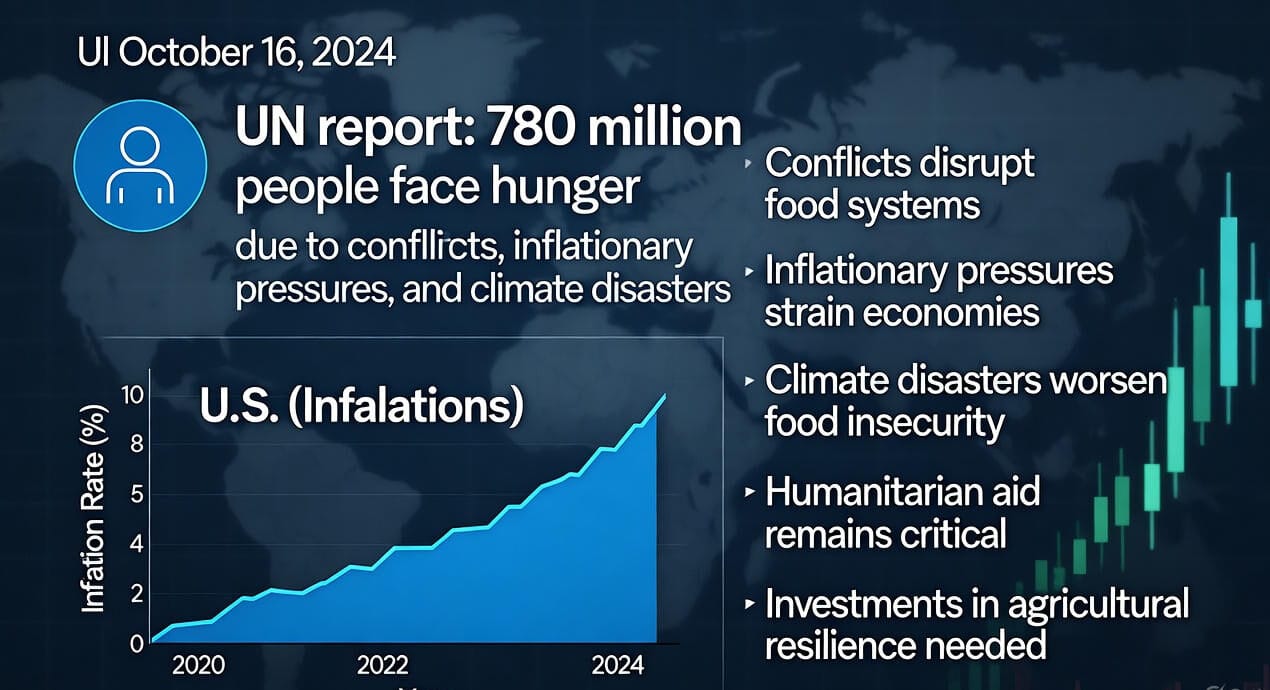

3. Macro Trends: The main point is that regulatory chatter in the cryptocurrency space is a very unpredictable factor (always a wild card in crypto) besides the headlines about the tariffs, fears of inflation, expected interest rates, and the behavior of the regulators.

Looking At The Future

While a 5% decrease is indeed substantial, the word “apocalyptic” hardly fits in a long history of Bitcoin’s ups and downs. The currency has seen much tougher times—imagine the 20% crashes within a day—and yet has managed to pull through to record new highs. For those who buy and hold for the long term, this will probably not more than a minor hiccup. For day traders, the situation is one of the high stakes.

It is rational to think that the destiny of the cryptocurrency is in the hands of the general economy, and that the process of the asset distinguishing its subsistence is still ongoing. The volatility experience in April 2025, triggered by the tarrifs, is an indication of the power oligarchic and state politics still wield even in a world of decentralized finance. The market is such that it gets noisier from time to time.

Concluding Words

If you are following the crypto scene, pay attention to how stock markets will react to these tariffs in the coming days. The fall of Bitcoin from $78,892.92 is a healthy step backward, but it is surely not the end of the road; on the other hand, it is an indicator that the market is getting more volatile. Regardless of whether you are HODLing or hedging, you should be more vigilant at present and watch the news. What are your thoughts? Is this a dip that leads to a buying opportunity or is it a precursor of worse times? The way crypto supporters handle the situation can give us an insight into the next move.