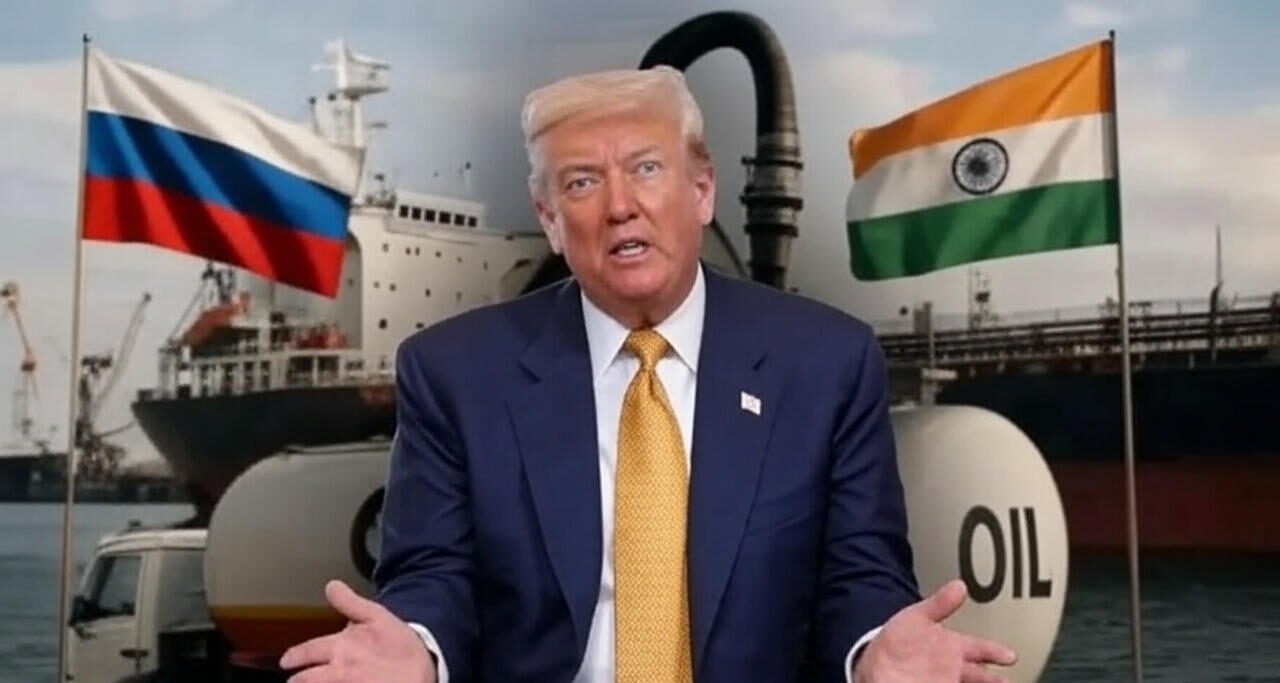

In a bold escalation of trade tensions, U.S. President Donald Trump has issued a stark warning to India, threatening “massive tariffs” on its exports unless New Delhi immediately halts its imports of Russian crude oil. This pronouncement, delivered aboard Air Force One on October 19, 2025, underscores the deepening rift between two major global economies amid ongoing geopolitical pressures from the Russia-Ukraine conflict. As the world’s third-largest oil importer, India’s reliance on discounted Russian energy has become a flashpoint in bilateral relations, potentially disrupting supply chains and inflating global energy prices. This development not only highlights Trump’s aggressive “America First” tariff strategy but also raises questions about the future of U.S.-India strategic partnerships in the Indo-Pacific region.

Understanding the U.S.-India Tariff Dispute

The roots of this tariff threat trace back to early 2022, when Western sanctions on Russia following its invasion of Ukraine prompted New Delhi to diversify its energy sources. India, facing volatile global oil markets, turned to Russian crude, which now accounts for over a third of its total imports—approximately 1.9 million barrels per day in October 2025 alone. This pragmatic move helped stabilize domestic fuel prices and curb inflation, but it has irked Washington, which views such purchases as indirectly funding Moscow’s war efforts.

Historical Context of Tariffs

Trump’s administration has progressively ramped up duties on Indian goods, starting with a 25% tariff in August 2025 explicitly tied to Russian oil transactions. By mid-October, these had doubled to 50%, with half attributed directly to energy imports from Russia. During a recent White House briefing, Trump emphasized that these measures are non-negotiable, stating, “If they want to say that, then they’ll just continue to pay massive tariffs, and they don’t want to do that.” This rhetoric echoes his broader policy of secondary sanctions, targeting not just adversaries but allies perceived as complicit in evading primary restrictions.

India’s Foreign Ministry has vehemently rejected these claims as “unfair, unjustified, and unreasonable,” arguing that U.S. encouragement in 2022 for India to import Russian oil—to bolster global energy stability—contradicts current pressures. A spokesperson noted that traditional suppliers were diverted to Europe post-invasion, leaving India with limited alternatives. Despite a reported 20% uptick in Russian imports this month, Indian officials insist on “broad-basing and diversifying” sources, including recent deals for 4 million barrels from Guyana via U.S. firm ExxonMobil.

India’s Strategic Reliance on Russian Oil

For India, Russian oil is more than a commodity—it’s a lifeline for economic resilience. With refining capacity geared toward heavier Russian grades, abrupt cessation could spike import costs by up to 30%, exacerbating fiscal strains amid a slowing GDP growth forecast of 6.8% for fiscal 2026.

Key Benefits of Russian Imports

- Cost Savings: Discounted prices (often 20-30% below Brent crude) have saved India an estimated $10 billion annually, shielding consumers from pump price hikes.

- Supply Stability: Russian volumes fill gaps left by OPEC+ cuts and Middle East disruptions, ensuring 85% refinery utilization.

- Geopolitical Neutrality: As a non-aligned power, India’s stance aligns with BRICS principles, avoiding full Western sanctions while maintaining ties with both Russia and the U.S.

- Environmental Edge: Processing Russian Urals crude yields higher diesel output, supporting India’s shift to cleaner fuels.

However, this dependency exposes vulnerabilities. Analysts warn that prolonged U.S. tariffs could erode India’s $36 billion trade surplus with America, hitting sectors like pharmaceuticals, textiles, and IT services hardest.

Global Energy Market Implications

Trump’s ultimatum reverberates beyond bilateral ties, injecting uncertainty into an already fragile global energy landscape. With Brent crude hovering at $75 per barrel, any Indian pivot away from Russia could tighten supplies, potentially adding $5-10 to prices worldwide.

Ripple Effects on Stakeholders

Under the subheading, consider the broader fallout:

- Russia’s Economy: Loss of India’s market—its largest post-sanctions buyer—could slash Moscow’s oil revenues by 15%, hampering war funding and accelerating ruble depreciation.

- U.S. Allies: European nations, still weaning off Russian gas, may face renewed shortages if India competes for alternative barrels from Saudi Arabia or the U.S.

- Developing Economies: Higher energy costs could fuel inflation in Asia and Africa, where 70% of nations import over 90% of their oil needs.

- OPEC Dynamics: Cartel members might ramp production to offset voids, but spare capacity limits (around 5 million bpd) constrain quick responses.

Trade negotiations, slated for November 2025, now loom as a high-stakes arena. U.S. envoy Steve Witkoff’s recent Moscow talks signal Washington’s multi-pronged approach, blending diplomacy with economic coercion.

Potential Pathways Forward

Resolving this impasse requires nuanced diplomacy. India could propose phased reductions in Russian imports, coupled with increased U.S. LNG purchases—a nod to mutual interests. Trump, in turn, might offer tariff exemptions for green tech collaborations, aligning with his administration’s push for American energy dominance.

Scenarios for De-escalation

- Short-Term Compromise: India caps Russian buys at 1.5 million bpd, earning a 10% tariff rollback.

- Long-Term Alliance: Joint U.S.-India ventures in Arctic drilling, diversifying sources while sharing tech.

- WTO Escalation: New Delhi files a formal complaint, invoking GATT rules on non-discrimination.

Yet, escalation risks persist. If tariffs hit 100% as hinted, Indian exporters warn of 500,000 job losses and a 2% GDP drag.

In conclusion, Trump’s tariff threat on India over Russian oil purchases exemplifies the intricate interplay of economics, security, and energy geopolitics. As global dynamics shift, both nations must navigate this tightrope to preserve a partnership vital for countering shared threats like China’s assertiveness. Stakeholders worldwide will watch closely, as the outcome could redefine trade norms in a multipolar world. For ongoing updates on U.S.-India relations and global energy tariffs, subscribe to our newsletter.

(Word count: 812)

References

- BBC News: Trump threatens 50% tariffs on India for buying Russian oil

- Reuters: Trump vows to keep ‘massive’ tariffs on India until Russian oil imports cease

- The Economic Times: ‘Cut Russian oil or continue facing massive tariffs’: Trump issues warning to India

- NDTV: India will continue to pay massive tariffs over “Russian oil thing”, says US President Donald Trump

- The Hindu: Trump says India to pay ‘massive tariffs’ if it continues to buy Russian oil