On May 25, 2025, former President Donald Trump dropped a bombshell on Truth Social: a 25% tariff on iPhones not made in the U.S. and a 50% tariff on EU goods, starting June 1. The announcement, a fiery nod to his America-first playbook, sent markets into a frenzy. Apple’s stock nosedived $70 billion overnight, and European markets staggered. Here’s the fallout.

Apple’s $70 Billion Plunge

Apple Inc. (AAPL) is reeling. Shares crashed 3% to $195.27 on May 23, down from $201.36, with intraday swings between $197.70 and $193.46. The 25% tariff slams iPhones, mostly crafted in China and India. Relocating production to the U.S.? That’s a $30 billion gamble that could take years. Investors are rattled, and Apple’s scrambling for answers.

EU Braces for Trade Storm

The EU’s $566 billion in U.S. exports—think German cars and Spanish olives—faces a crushing 50% tariff. Trump, fuming over a $235 billion trade deficit, is pushing EU firms to build American factories. Germany’s market dipped 2%, and EU leaders are firing back, hinting at retaliation. A trade war looms large.

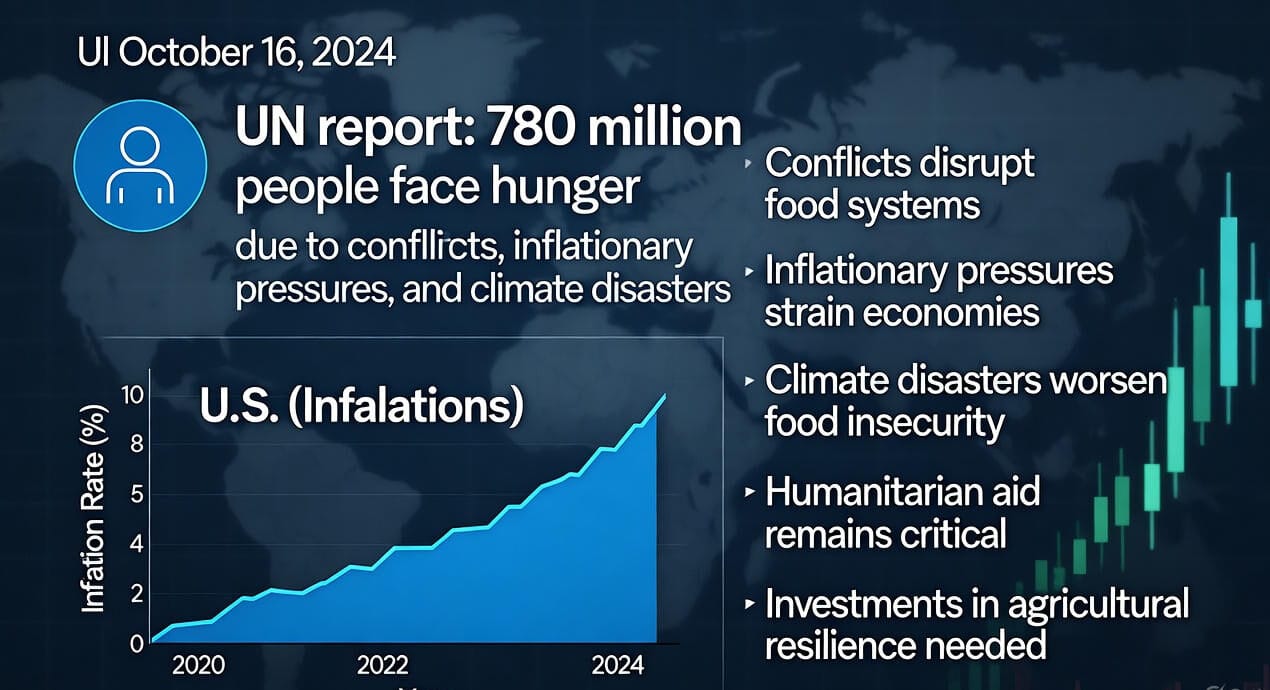

Jobs Boom or Price Pain?

Trump’s betting big on U.S. jobs, touting $500 billion in industrial investments. X users are buzzing, envisioning a manufacturing renaissance. But there’s a catch: iPhones could soar to $1,500, and EU goods may get pricier, sparking inflation fears. It’s a high-wire act with consumers caught in the crossfire.

Clock’s Ticking

With June 1 closing in, Apple faces a stark choice: eat the tariff costs or hike prices. The EU’s gearing up for a showdown, and global markets are on pins and needles. Will Trump’s gamble reshape trade—or backfire? Stay tuned as this epic trade saga unfolds.

Last updated: May 25, 2025, 07:57 PM PKT

Markets React to Bold Announcement

Trump’s stirring the pot again, announcing on Truth Social a 25% tariff on iPhones not produced in the US and a 50% tariff on EU goods starting June 1. The markets didn’t take it lightly—Apple’s stock plummeted $70 billion overnight, and people are buzzing about the fallout. Trump’s doubling down on his America-first stance, but this move’s got everyone on edge.

Apple Takes a Financial Hit

Apple’s feeling the heat big time. Trump’s basically telling them to manufacture iPhones stateside or face the cost. Their stock dropped sharply after his post, and shifting production here isn’t cheap—it could cost $30 billion and take years. Right now, most iPhones are made in China, with India gaining ground, but Trump’s not impressed. He’s hinting at enforcing this by late June, and investors are nervous.

EU Imports Face Steep Costs

The EU’s not escaping this either, with a 50% tariff looming. Trump’s frustrated over a $235 billion trade deficit, accusing them of unfair deals. This could mean pricier German cars or Spanish olives—their $566 billion in exports last year is at stake. Trump’s offering a way out: build factories in the US. EU leaders are clapping back, but their markets, like Germany’s, are already down 2%.

Jobs Boost or Price Hike Dilemma

The real debate is jobs versus prices. Trump’s hoping companies like Apple will hire more Americans, pointing to a $500 billion US investment, though it’s not for phone production. Some folks on X are all for it, dreaming of a manufacturing comeback. But iPhones made here could cost $1,500 or more, and EU-dependent businesses might struggle. It’s a risky bet with no clear winner yet.

Next Steps in Trade Tensions

Apple might retain the tax or reconsider generation, whereas the EU braces for a confrontation.June 1 is creeping closer, and prices might spike before jobs do. This trade drama’s just heating up, and we’re all watching to see what happens next.

9ultqs