On August 1, 2025, global markets are dealing with the effects caused by the U. S.

President Donald Trump’s announcement of sweeping new tariffs targeting 68 countries and the European Union, set to take effect on August 7. The policy, which imposes duties as high as 35% on select goods from nations including Canada, has triggered sharp declines in European stock markets and raised alarms about economic instability, supply chain disruptions, and rising consumer prices in the United States.

A Bold Trade Policy Shift

The tariffs, part of President Trump’s broader “America First” economic agenda, aim to protect domestic industries and address trade imbalances. The administration argues that the measures will boost U.S. manufacturing and reduce reliance on foreign imports. However, the decision has drawn criticism from economists and international leaders, who warn of retaliatory trade measures and a potential slowdown in global economic growth.

Canada, a key U.S. trading partner, faces a 35% tariff on certain goods, including automotive parts and energy products. European nations, already navigating post-Brexit trade complexities, are bracing for duties on a range of exports, from agricultural products to industrial machinery. The European Union has signaled its intent to negotiate exemptions, but talks remain in early stages, with time running out before the August 7 deadline.

Market Reactions and Economic Ripples

European stock markets experienced significant declines following the announcement. The STOXX 600 index fell by 2.3%, with German and French markets seeing steeper losses. Shares of European exporters, particularly in the automotive and luxury goods sectors, were hit hardest as investors anticipate reduced U.S. demand. In Asia, markets in Japan and South Korea also dipped, reflecting concerns about global trade disruptions.

Producers across Europe report immediate challenges. In Germany, manufacturers of precision machinery noted a 15% drop in U.S.-bound shipments within days of the announcement. French wine producers, already strained by previous trade disputes, face higher costs that could render their products uncompetitive in the U.S. market. In Canada, energy companies warn that tariffs on oil and gas exports could lead to supply chain bottlenecks, potentially increasing fuel prices for U.S. consumers.

Domestic and International Fallout

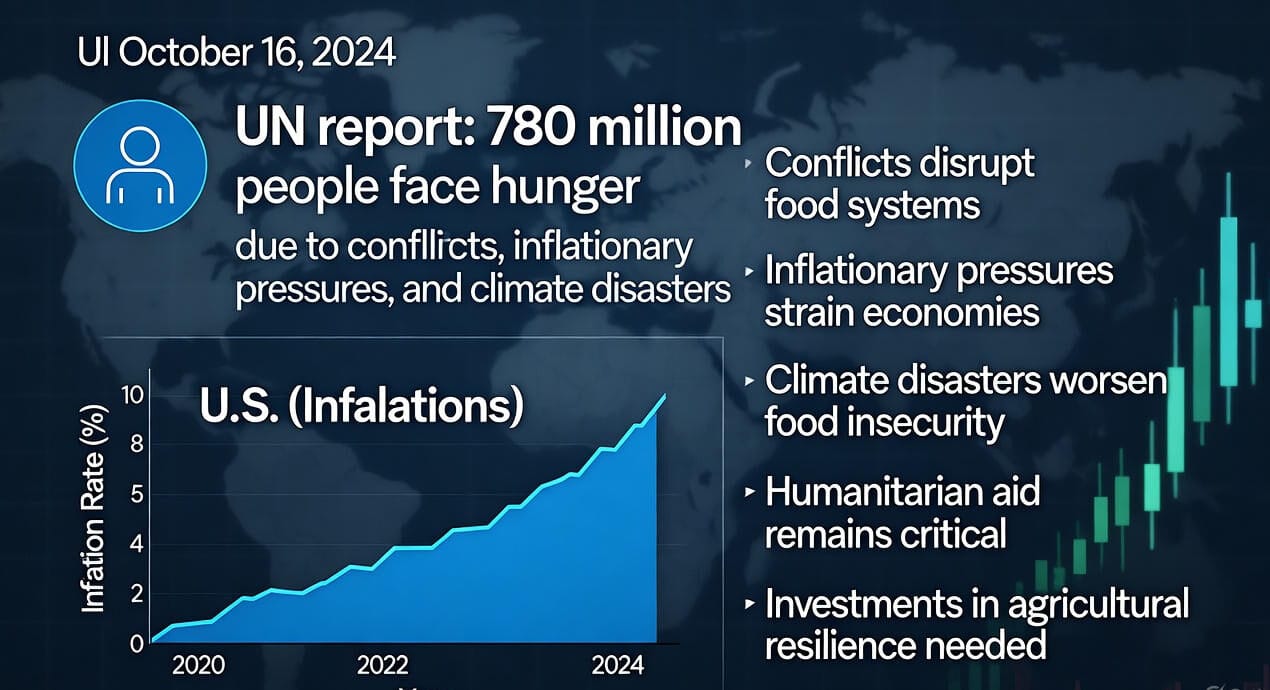

In the United States, the tariffs are expected to raise prices for a range of goods, from electronics to food products. Economists estimate that the average U.S. household could face an additional $1,200 in annual costs, exacerbating inflationary pressures already felt in sectors like housing and energy. Retailers, reliant on imported goods, have warned of price hikes on consumer staples, potentially dampening demand during the critical holiday shopping season.

Internationally, the policy has strained diplomatic relations. Canadian Prime Minister Justin Trudeau called the tariffs “a step backward for North American economic integration,” hinting at retaliatory measures. The European Commission is preparing a response, with potential counter-tariffs on U.S. exports like bourbon, motorcycles, and agricultural products. Developing nations among the 68 targeted countries, many of which rely on U.S. markets for growth, face acute risks of economic slowdown.

Negotiations and the Path Forward

As the deadline approaches, countries are scrambling to secure exemptions or trade concessions. U.S. Trade Representative Katherine Tai has indicated openness to bilateral deals, but the administration’s hardline stance suggests limited flexibility. European leaders, meeting in Brussels, are coordinating a unified response to avoid a fragmented approach that could weaken their negotiating power.

Analysts remain divided on the long-term impact. Some argue the tariffs could strengthen U.S. industries by encouraging domestic production, while others warn of a global trade war that could mirror the economic disruptions of the 1930s Smoot-Hawley Tariff Act. For now, businesses and consumers worldwide are bracing for uncertainty as the global economy navigates this bold policy shift.