I’m sitting here thinking about the news that dropped yesterday, June 4, 2025—President Trump doubled the US tariffs on steel and aluminum to a steep 50%. It’s a bold move that’s already sending ripples through global markets, with gold prices climbing and economists warning of trouble ahead. I can’t help but wonder if this is a quick win for American workers or a gamble that’ll leave us all with a bigger headache down the road.

US Tariffs Jump to 50 Percent on Steel and Aluminum

The announcement came straight from the White House yesterday—US tariffs on steel and aluminum imports are now at 50%, effective immediately. I picture Trump standing at a podium, talking about protecting American jobs, and I get why that resonates. The steel industry in places like Pittsburgh has been struggling for years, and this could mean more work for folks there. But I’m also thinking about the flip side—how this hits countries like Canada and Brazil, big exporters to the US, and what they might do in return. It feels like the kind of decision that sounds good on paper but might get messy fast.

US Tariffs Spark Market Jitters Worldwide

Today’s market reaction tells me I’m not alone in my unease. Gold prices shot up to $3,398 an ounce, a 0.7% jump, as investors scramble for safe bets. I can imagine traders in New York and London staring at their screens, wondering if this means a full-blown trade war. When US tariffs hit this hard, it’s not just steelmakers who feel it—everyone from car manufacturers to soda can makers relies on these metals. I’m picturing factory bosses in Detroit, already dealing with tight margins, now facing higher costs. It’s no surprise the markets are spooked, and I’m curious to see how far this ripple goes.

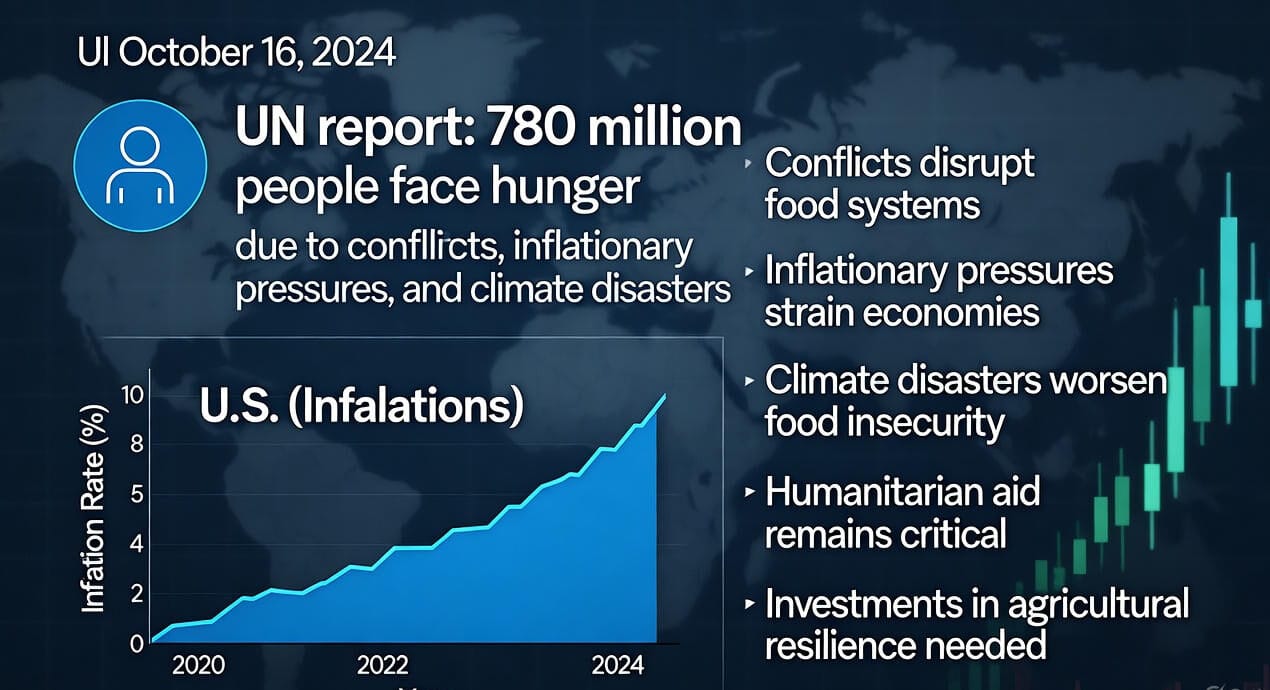

US Tariffs Could Fuel Inflation, Warn Experts

The Congressional Budget Office didn’t mince words today—they predict a 0.4% inflation spike over 2025-2026 because of these US tariffs. I think about families already stretched thin at the grocery store, now facing higher prices for everything from cars to canned goods. Steel and aluminum touch so much of what we buy, and those costs don’t just vanish—they get passed on to us. I’m wondering how this plays out for folks in small towns, where every dollar counts. The CBO’s warning feels like a red flag, and I’m not sure if the White House has a plan to soften the blow.

US Tariffs Divide Opinions: Jobs vs. Costs

Of course, not everyone’s worried. Supporters of the US tariffs, like steelworkers in Ohio, are probably cheering. I can see why—they’re hoping for more shifts, maybe even a factory reopening. Trump’s team says this protects American jobs from “unfair” foreign competition, and that’s a promise that won them votes. But critics aren’t buying it. They argue these tariffs could backfire, hurting US industries that need imported metals—like automakers and construction firms. I’m torn, honestly. I want to root for local workers, but I can’t shake the feeling that this might cost more jobs than it saves.Its a bet, and I am not beyond any doubt who’ll win.

US Tariffs Raise Questions About the Future

As I type in this, I am considering what follows. These US tariffs might push other countries to hit back—maybe Canada slaps tariffs on US whiskey, or the EU taxes American tech. I remember the trade wars a few years back, how they dragged on with no clear winner. Gold prices climbing today tell me investors are bracing for that kind of mess again. I’m also wondering about Trump’s timing—doubling tariffs now, mid-2025, feels like a flex, but is it for the economy or the headlines? With inflation already a worry, I’m skeptical this will end as smoothly as the White House hopes.

My Take on the US Tariffs Move

I’ve been turning this over in my head all day. The US tariffs on steel and aluminum might give a boost to some American workers, and I can’t fault the idea of protecting homegrown industries. But the risks—higher prices, trade wars, and maybe even job losses elsewhere—loom large. I picture a family in Texas, thrilled their dad’s steel mill has more orders, but then they’re paying more for a new car.It feels like a trade-off with no simple reply. I hope I’m wrong, but I suspect this decision will stir more trouble than triumph. What do you think—will these US tariffs pay off, or are we in for a rough ride?